What is a

Real Estate Swap ?

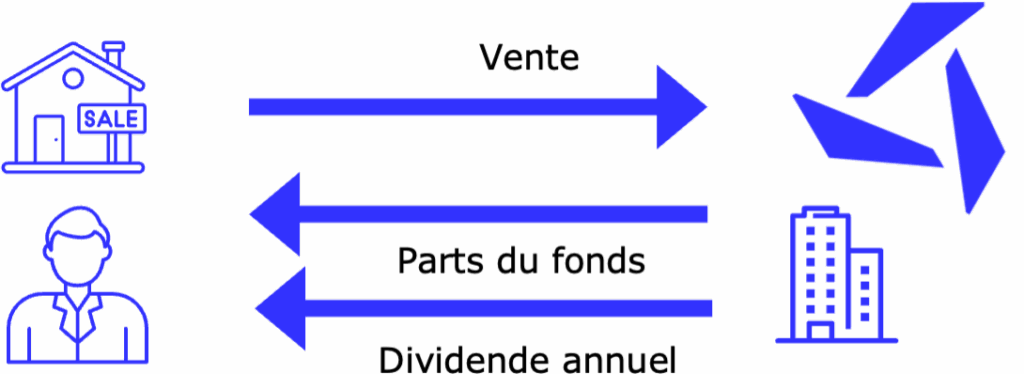

A Real Estate Swap is a form of capital increase that involves exchanging property for shares in a real estate fund. Instead of selling the property on the open market, the owner contributes it directly to the fund as a contribution in kind. In return, the owner receives newly issued fund shares equivalent to the agreed property value.

This mechanism enables the fund to expand its portfolio without deploying cash, while the property owner gains immediate access to a diversified, professionally managed investment vehicle along with an annual dividend. The key advantages for property owners are outlined below.

Key benefits of a swap

Financial and

Wealth Benefits

Property transition

Conversion of real estate assets into fund units, providing indirect exposure to real estate.

Access to Net Asset Value

Entry into the fund at Net Asset Value (NAV), without premium, offering investors full valuation of their property at the time of the swap.

Simplified succession

Divisible fund units facilitating fair and simplified inheritance processes.

Tax advantage

Income and wealth linked to the properties are taxed directly at the fund level. As a result, the dividend is exempt from income tax and the invested share in the fund is exempt from wealth tax for investors domiciled in Switzerland.

Liquidity

Possible sale of units over-the-counter (OTC) via our partner SFP and Dominicé’s investor network.

Lombard credit

Lombard loan available depending on the investor’s custodian bank.

Operational and

Environmental Benefits

Professional management

Properties managed by experts to optimize costs and returns.

Risk reduction

Limiting operational risks associated with direct property ownership.

Sustainability and energy transition

Renovations and upgrades to meet future environmental requirements, in line with the Paris Agreement and the objectives of the Swiss Confederation.

Tailored

solution

Real estate property(ies) can be securitized fully or partially.

- Full securitization: The sale of the property is immediately converted into fund units.

- Partial securitization: Part of the property’s value is distributed in cash, and the remainder in fund units

From direct to indirect investment

1.

Determine and agree on the property purchase price and the sale date.

2.

The fund management company and the custodian bank determines the issue price per unit.

3.

The notarized sale deed formalizes the transaction, converting the purchase price into a corresponding number of fund shares, calculated on the valuation date.

4.

Determine and agree on the property purchase price and the sale date.

Let’s Talk

Click below to continue the conversation. Our team will be pleased to walk you through the swap opportunities in detail.