Published in Immo26 Magazine, on the occasion of the 14–15 January 2026 event.

Michel Dominicé, Senior Partner, Dominicé

An Appeal That Shows No Signs of Fading

In Europe, few countries are as attractive as Switzerland. Over the past forty-five years, its population has increased by 43%, far more than France (+23%), Austria (+21%), Germany (+7%) or Italy (+4%). A success story, certainly—but not without consequences: this demographic vitality is now driving some of the strongest tensions in the Swiss real estate market.

When Demand Outpaces Supply

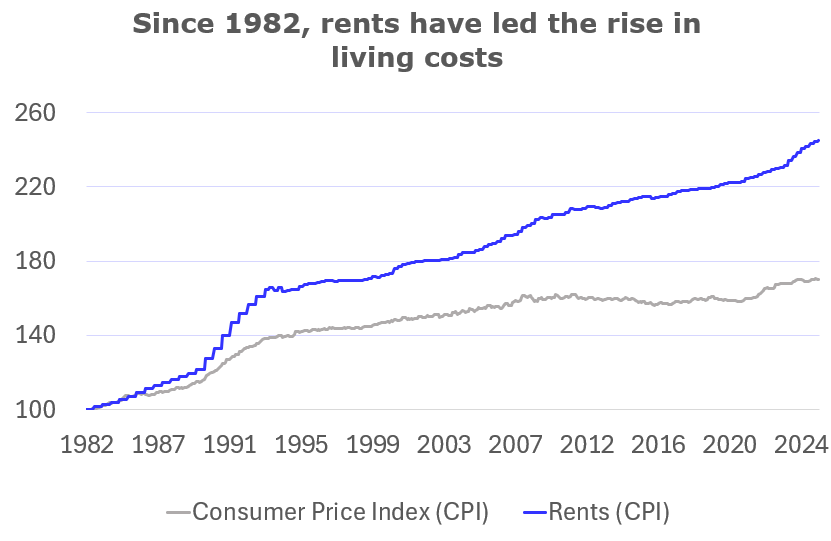

Why does Switzerland attract so many people? Its stability, safety and quality of life form a winning combination. But this growth—largely fueled by immigration—has led to two major effects: sustained construction activity and rent inflation rising faster than consumer prices. Since 1982, the general price index has increased by 70%, while the rent index has surged by 145%.

A Country Deeply Attached to Its Landscape

So why not build more? Switzerland remains deeply committed to preserving its green spaces. In addition, public infrastructure—roads, schools, transport—must keep pace with population growth, slowing down new projects. Finally, Switzerland has chosen qualitative rather than quantitative development: a model consistent with its culture, yet one that reinforces the scarcity and high cost of housing.

An Economic Filter on Immigration

This preference for quality is also reflected in Switzerland’s migration policy. The system tends to favor individuals who are highly qualified or financially well-off. The high cost of housing, health insurance and basic goods acts as a first barrier to entry. Another key mechanism reinforces this dynamic: access to the social welfare system generally requires employment, discouraging migrants with limited resources. These conditions ultimately redirect those without sufficient means toward other countries.

Zurich, Basel, Lake Geneva: The Winning Poles

Where is this growth concentrated? In the major economic hubs. Zurich, Basel and the Lake Geneva region attract talent, capital and businesses. These regions—engines of the knowledge economy—feed a virtuous cycle of skills and wealth. Yet this polarisation leaves some areas behind, where economic momentum remains weaker.

Housing: A New Political Battleground

As rents continue to soar, political tensions are rising. Should rents be regulated? Should the State intervene? Some parties advocate rent controls, or even public acquisition of residential buildings to preserve affordability. Others fear that such intervention would further complicate an already strained market.

The Unintended Consequences of Regulation

These policies, though well-intentioned, often generate adverse effects. Capping rent increases sustains a chronic shortage: long-standing tenants benefit from low rents, while newcomers struggle to find housing. Mobility suffers. Moreover, as overall housing demand grows, protected tenants remain insulated from price adjustments; excess demand then concentrates in the unregulated segment of the market, accelerating rent increases there. In the end, public support granted to some comes at the expense of everyone else.

The Rise of Indirect Real Estate

In this context, what prospects for investors? Despite these tensions, the outlook remains strong. Social and regional polarisation is likely to continue pushing property prices and rents higher, especially in the most dynamic areas. Political tensions and increased state involvement could nevertheless disrupt the market through growing procedural complexity—whether in leasing, construction or renovation.

This market, attractive yet increasingly demanding, will likely favour large property owners and indirect real estate vehicles, which are better equipped to operate in an environment that grows more complex year after year.