PricewaterhouseCoopers (PwC) invited our Senior Manager Michel Dominicé to take part in the presentation of the results of its annual study Emerging Trends in Real Estate Europe, published in collaboration with the Urban Land Institute (ULI).

This study serves as a benchmark for assessing the evolution of real estate markets. The 2025 edition, presented by Jean-Sébastien Lassonde, Swiss Leader Asset & Wealth Management at PwC Switzerland, highlights a profound transition marked by deglobalisation, increased volatility, political uncertainty and a fragmentation of investment strategies that are becoming increasingly regional.

While Europe is facing multiple challenges, Switzerland continues to be perceived as an attractive investment destination, despite growing structural tensions.

Below, discover the key insights shared by Michael Loose, Chair of ULI Switzerland (Romandy), Mathilde de La Pomélie, Director Asset & Wealth Management at PwC Switzerland, Michel Dominicé, Senior Partner at Dominicé, and Vinh Dao, CEO of the Praille–Acacias–Vernets (PAV) Foundation.

PwC & ULI Perspectives: Towards More Localised Strategies

During his intervention, Michael Loose, Chair of ULI Switzerland (Romandy), presented the key findings of the study, based on more than 1,200 interviews with representative real estate market participants. According to him, the study reveals a more demanding European market: “real estate asset values are increasingly being put to the test”, in a context of geopolitical instability and at a time when artificial intelligence “will transform our lives and the way we work”, making markets “structurally more volatile”.

Access the study here: Emerging Trends in Real Estate 2025 | PwC Switzerland

In Switzerland, the prevailing sentiment remains that of a safe-haven asset: “All economic indicators are performing very well”, although some worrying signals are beginning to emerge. The European situation is far more contrasted. Following a period of post-COVID euphoria and renewed optimism after the inflation and interest rate shock, confidence is now weakening. Loose identifies three key factors: “political uncertainty, escalation of global conflicts and a lack of affordable housing.” Rising prices and increasing regulatory pressure further reinforce this cautious stance.

Regarding capital flows, he notes that US instability could theoretically benefit Europe, but that American investors “remain focused on growth that is perceived as too moderate in Europe.” Investment volumes confirm this trend: the UK leads, followed by Germany; France remains stagnant, while Spain is showing strong momentum. Nevertheless, “financing in Europe remains available” to support a recovery in transactions.

Switzerland illustrates this resilience well. The system absorbed the Credit Suisse episode without major disruption, and while Basel IV is putting pressure on margins, access to credit remains smooth in a market still largely bank-financed, with “alternative debt volumes still very low.”

In terms of city attractiveness, London, Madrid, Paris and Berlin dominate the rankings, while Zurich has slipped due to higher prices and “more burdensome regulation.” From a sector perspective, investors are favouring segments driven by megatrends, such as data centres and new energy infrastructure, alongside sustained interest in residential real estate in Switzerland — even if these emerging sectors remain marginal in terms of overall volumes.

Loose describes a transition phase shaped by the “4+1 Ds” — demographics, deglobalisation, digitalisation, decarbonisation, to which he adds a new one: defence — now serving as structural reference points for investment strategies. ESG is also evolving: “ESG has shifted from an idealistic approach to a more realistic one”, centred on energy efficiency and climate risk management, which has become a genuine exclusion criterion for many investors.

In conclusion, he stresses that “geopolitical uncertainty increases the volatility of global real estate markets.” Capital remains available, but now requires “clear and credible growth strategies.” In this transition phase, the five Ds are emerging as long-term trends, and “sector and location choices will become increasingly decisive for performance.” Finally, Loose emphasises the decisive role of technology, with AI “emerging as a key driver of real estate innovation”, calling for a profound transformation of industry models.

PwC Analysis: A Solid but Tight Swiss Market

Mathilde de La Pomélie presented the PwC study results for the Swiss real estate market, valued at approximately CHF 5,000 billion. According to her, the 2023–2024 period was characterised by “CHF 240 billion in value creation”, driven by both valuation effects and transactions. Average property values increased by around 1%, while rents rose by 6%, supported by exceptional migration inflows and strong pressure on rental demand.

Despite a challenging environment, she notes that “investment opportunities still exist.” Transactions were financed primarily through capital increases within real estate funds — a notable shift compared to the previous year, which was dominated by pension investment foundations.

She also highlighted the continued rise of ESG disclosures in annual reports. ESG approaches have become more pragmatic than idealistic and must now make financial sense. Net-zero transition plans are multiplying, often developed with the support of specialised providers such as Signaterre. Asset managers are strengthening energy monitoring, district heating connections and portfolio optimisation programmes.

For PwC, this professionalisation marks a new phase: energy efficiency is becoming a standard, while climate risk is now viewed as a “true deal-breaker” for investors. Monitoring tools are becoming more sophisticated, providing greater visibility on the impact of renovations, energy performance and net-zero trajectories.

Read also: From Data to Impact: DSPF’s ESG Roadmap | Dominicé

Mathilde concluded by emphasising that, even in a pressured market, transaction activity remains coherent: market participants are refocusing on the quality of financial and sustainability indicators, and real estate funds continue to demonstrate their ability to mobilise capital in an increasingly selective environment.

The Knowledge Economy as a Driver of Real Estate Dynamics – Michel Dominicé

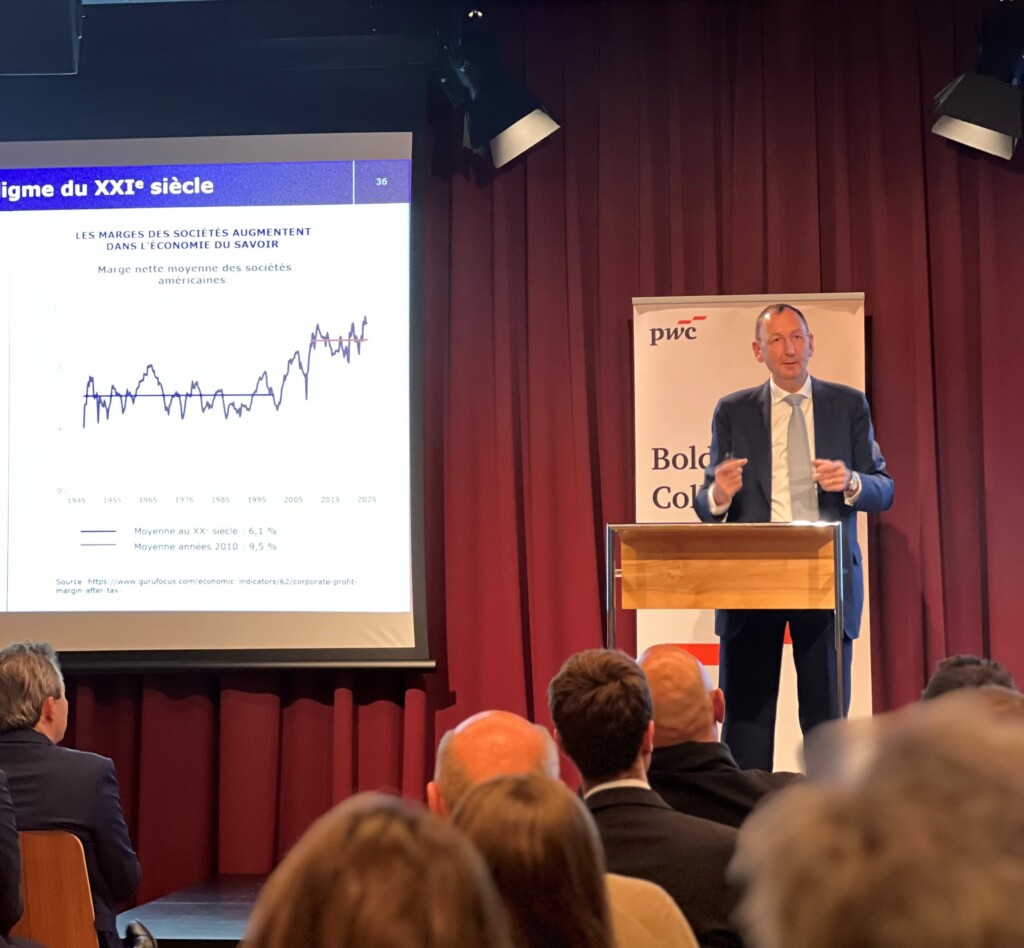

For Michel Dominicé, understanding the Swiss real estate market first requires understanding a broader economic transformation: the shift from traditional capitalism to the knowledge economy. He explains that this transition is driven by an economy in which product value increasingly relies on intangible components. This shift is reflected, for example, in the evolution of US corporate margins: “average margins have risen from 6.1% to 9.5% since 2020.”

This increase reflects a new economic logic in which production is primarily based on ideas and concepts, while marginal reproduction costs are extremely low. This mechanism allows margins to rise and introduces deflationary pressure, making persistently low — or even negative — interest rates possible, something previously considered unthinkable.

What applies to products also applies to companies: capital is becoming increasingly intangible. This transformation is illustrated by the balance sheet of the Swiss National Bank. Before 2008, sight deposits amounted to around CHF 5 billion. “Today, the SNB’s balance sheet stands at CHF 400–500 billion… to achieve the same outcome.” This liquidity explosion does not reflect excess capital, but rather a lack of investment opportunities: “Having capital is not enough — the real issue is finding investment opportunities.” The banking system is saturated, excess liquidity accumulates, and the credit market becomes constrained by risk premia — explaining, in his view, seven years of negative interest rates.

Read also: Are negative interest rate back on the horizon in Switzerland? | Dominicé

This shift also leads to social and regional polarisation. The knowledge economy concentrates high incomes in a few hubs: Zurich–Zug–Schwyz, the Basel region and the Lake Geneva area. Where information flows, real estate values rise faster: “The economic elite must live where information circulates.” In these regions, rents increase more rapidly than in peripheral areas with lower information density and wealth. These hubs share common characteristics: proximity to airports, competitive taxation and high value-added industries.

Switzerland’s structural strengths make it a powerful magnet. This has resulted in strong demographic growth (+40% over 40 years) and a comparable increase in real rents. Michel notes that some of this pressure could have been absorbed, but Switzerland made a clear political choice: prioritising quality over quantity. Resistance to urban sprawl, efforts to limit infrastructure strain and a natural filtering mechanism at the country’s entry points have resulted in a structurally tight market. “Living in Switzerland will become more expensive,” he summarises.

This dynamic also places pressure on lower-income households, as the arrival of highly qualified profiles pushes rents higher and fuels sensitive political debates. State interventions aimed at regulating prices have their limits: they tend to create clientelism, exacerbate shortages and lengthen waiting lists.

Linking these factors to real estate positioning, Michel recalls the distinction between tangible and intangible assets: “In a world that has become highly intangible, real estate remains a sanctuary of capitalism.” In the knowledge economy, physical presence in locations where high-value interactions and information exchanges occur becomes a strategic advantage. A building located in an information hub “has far greater value than one located in the middle of nowhere.”

Artificial intelligence further reinforces this dynamic by acting as a powerful lever for high value-added individuals, accelerating talent concentration and deepening territorial inequalities. Finally, abundant savings — fuelled by the relocation of significant wealth to Switzerland — are pushing interest rates lower and amplifying real estate price increases, especially as zero or negative rates are increasingly perceived as a durable phenomenon.

PAV (Praille–Acacias–Vernets): A New Centrality for Geneva

The intervention of Vinh Dao, CEO of the Praille–Acacias–Vernets Foundation, provided an update on one of Europe’s most ambitious urban development projects. He opened by recalling the spirit of the PAV project: “We are transforming a historic industrial area into a genuine piece of city, designed to meet Geneva’s needs in 2050.”

Covering more than 230 hectares, the PAV area represents the canton’s largest land reserve and will play a decisive role in addressing the housing shortage.

Vinh Dao highlighted the scale of the transformation underway: the creation of nine neighbourhoods combining housing, economic activities, public facilities and green spaces, each structured around functional mix and urban quality. “These future districts must become exemplary — sustainable, inclusive and resolutely future-oriented,” he stressed.

Among the major milestones, he mentioned the recent approval of the planning framework for the project’s two landmark towers, rising to 170 and 175 metres, set to reshape Geneva’s skyline. “These towers symbolise a key step: they show that Geneva is now willing to combine density, architectural ambition and sustainability.” An international architectural competition will be launched to define their design and integration.

He also referred to the first projects under construction, notably in the Étoile sector, where 319 housing units will be delivered in a 28-storey tower and two complementary buildings. “We aim to offer more than housing: places to live, cultural spaces, retail and social connections built around contemporary urban life.”

Ecological transition is another key pillar. Vinh Dao highlighted the ongoing renaturation of the Drize river, with 450 metres already reopened: “Bringing nature back into the city is not an add-on — it is an essential component of quality of life and Geneva’s climate resilience.”

From an institutional and land governance perspective, the project relies on close coordination between the State of Geneva, the PAV Foundation and the FTI, operating under an urban development operator model. This structure ensures coherent development and a balanced allocation of urban functions. He also reiterated the project’s social objective: “More than 60% of housing within the PAV perimeter will include a public utility component. Social mix is not a slogan — it is a commitment.”

In conclusion, Vinh Dao positioned the PAV project within the canton’s broader economic and societal challenges: attractiveness, sustainability, innovation and ecological transition. “The Praille–Acacias–Vernets project is not a simple urban regeneration. It is a strategic transformation that redefines how Geneva grows, welcomes, houses and innovates.”