Find the communication in German here: http://bit.ly/4nRNRvL

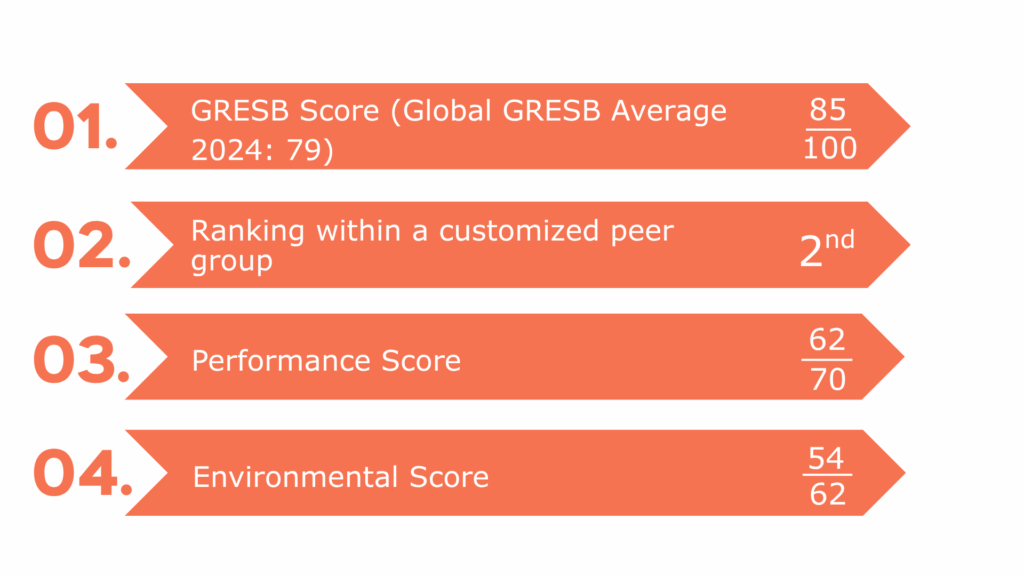

DSPF made a strong advance in the 2025 GRESB ranking, earning 4 stars and an overall score of 85/100, compared with one star in 2024. In its second year of participation, the fund now ranks above the global GRESB 2025 average of 79 points and has earned the GRESB Green Star, recognizing participants with strong overall performance. This major improvement reflects the implementation of a solid ESG governance framework, rigorous data monitoring, and concrete sustainability initiatives.

The fund ranks 2nd in the “Switzerland | Diversified | Residential” category, with an environmental score of 54/62, higher than the average of its peers. These results reflect the energy-efficiency measures implemented to reduce energy consumption and CO₂ emissions — notably through intelligent boiler management (–546 MWh over the 2024–2025 period) in collaboration with E-NNO Switzerland SA, as well as through rainwater recovery and effective waste management.

Our performance score of 62 out of 70 demonstrates robust and active governance based on rigorous risk assessment, continuous improvement, and audited reporting ensuring transparency and reliability. Signa-Terre SA and Pom+ Consulting SA support us in the energy transition of our portfolio, providing real-time monitoring of building consumption and assisting in the implementation of action plans.

Moreover, it is essential for us to involve our tenants and communities in our sustainability goals. The fund therefore operates with green leases, promotes sustainable practices through the sharing of green tenant guides, and has defined a renovation charter that now governs the interventions of contractors, integrating the fund’s ESG principles into every project. Thanks to our partnership with NeoVac SA, a recognized Swiss leader in energy management, it is now possible to perform actual, individualized heating cost allocations for each tenant. This approach ensures a fair and precise distribution of energy costs, encouraging responsible consumption.

“This result demonstrates a strong collective commitment. In just two years, we have built a solid ESG governance structure, deployed precise monitoring tools, and embedded sustainability factors into investment decisions. We are convinced that by integrating sustainability factors into our assets and relationships, we strengthen the resilience and longevity of our portfolio while creating shared value for our investors and tenants.”

— Diego Reyes, Senior Fund Manager

Our commitments and key figures as of June 30, 2025 :

- Rigorous monitoring and increased transparency: data coverage rate of 97.41%

- Clear 10-year roadmap guided by our initiatives toward carbon neutrality by 2050

- Active collaboration with partners and tenants to reduce the portfolio’s carbon footprint:

- Energy intensity down –2.52% vs. 2023

- CO₂ emissions (Scopes 1+2) down –1.23% vs. 2023

- Responsible resource and waste management: integration of sustainable practices in renovations, waste reduction, and optimization of material flows

We thank pom+ Consulting SA, which has supported us for the second consecutive year as part of the GRESB certification process. Their expertise helps us not only collect and analyze the necessary data but also implement concrete measures to improve our environmental impact.

The GRESB (Global Real Estate Sustainability Benchmark) provides real estate managers with comparable ESG data, analytical tools, and opportunities for investor dialogue. In 2024, over 2,200 property companies, funds, REITs, and developers — representing USD 7 trillion in assets and more than 200,000 properties across 80 markets — participated in the assessment.

Read our full Sustainability Report here: Sustainability | Dominicé

Our fund contract has been amended to incorporate this commitment and was approved by FINMA on May 27, 2024. Due to the implementation of an investment policy based on the “integration of sustainable factors” approach, the fund is not defined as a sustainable collective investment scheme, is not managed as a sustainable fund, and is not considered a sustainability-related collective investment within the meaning of the AMAS self-regulation on transparency and disclosure for sustainability-related collective assets.